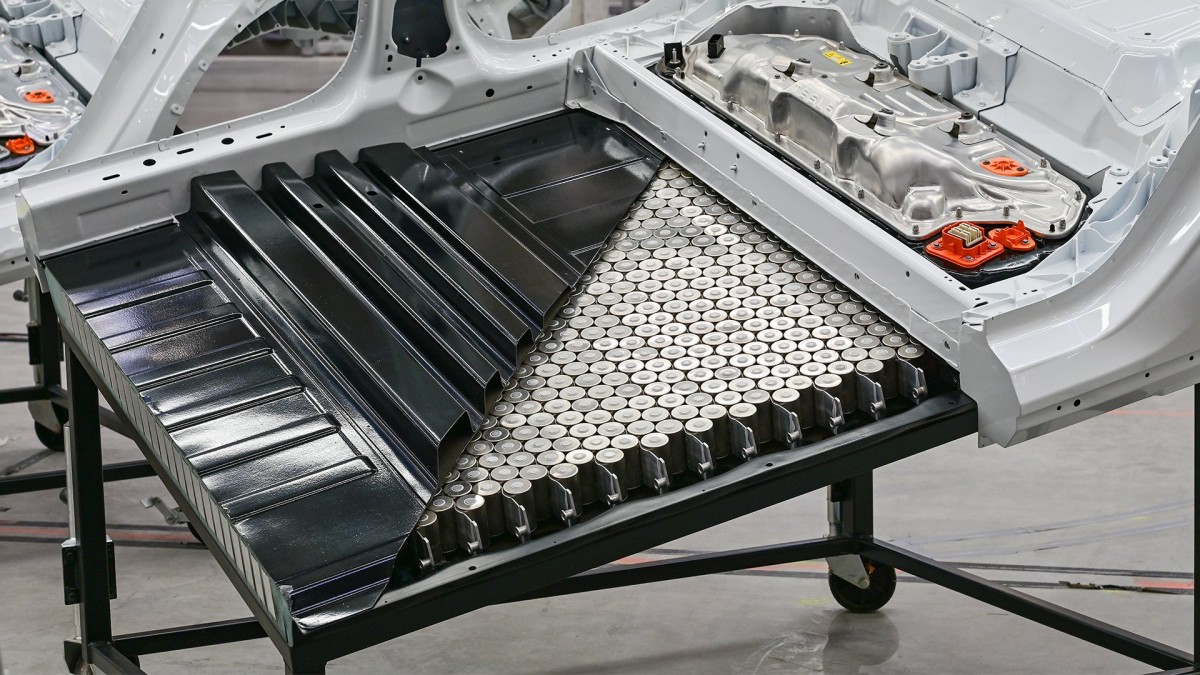

Tesla and CATL jointly develop faster charging batteries

Tesla is teaming up with CATL, the world's largest battery producer, to make electric cars charge faster and become even more affordable.

The success of the project would enable the creation of the $25,000 Tesla.

But the partnership extends beyond batteries. Tesla's Nevada factory now uses CATL-supplied machinery. Previous reports mentioned Tesla's plans to set up a small Nevada facility specifically for this purpose. The new move further solidifies the budding collaboration between the two industry giants.

CATL automated battery production

CATL automated battery production

It's not just Tesla that benefits from CATL's innovation. Automakers like BMW, Mercedes-Benz, and Nio rely on CATL's highly durable and cost-effective lithium-iron-phosphate batteries for their EVs. This advantage has fueled CATL's impressive earnings growth, even amidst looming concerns about global EV demand slowdown.

US geopolitical restrictions effectively prevent CATL from selling products directly in the US market. Undeterred, the company is charging ahead with a clever workaround: licensing its battery technology to partners in exchange for royalties.

CATL's licensing, royalty, and services (LRS) model is proving successful, and the company plans to train engineers from Ford in China and Germany. Zeng revealed talks with up to 20 other US and European automakers about similar licensing arrangements.

Ford's deal with CATL, sealed in February 2023, will see the US automaker build batteries in Michigan using CATL's tech. While political pushback exists, the project remains on track for a late 2026 launch. However, capacity has been revised down to around 20 GWh from the initially reported 35 GWh.

As the US aims to counter China's EV supply chain dominance, Zeng emphasizes the importance of trusted partnerships transcending politics. Biden's climate law includes significant investment to help the US compete with China, making strategic alliances even more crucial.

CATL is already manufacturing Sodium-Ion batteries

CATL is already manufacturing Sodium-Ion batteries

"Geopolitical tensions create complications for us," Zeng admits, "but what ultimately matters is maintaining client trust, regardless of short-term politics. Our track record speaks for itself."

With the LRS model its only ticket to overseas markets, CATL is also looking at production hubs in Europe and Southeast Asia. To fuel its international expansion, the battery behemoth may consider a secondary listing, but Zeng assures that CATL's financials are strong, so there's no immediate rush.

Facebook

Twitter

Instagram

RSS

Settings

Log in I forgot my password Sign up